Apple’s latest earnings report is aapl earnings under the microscope, revealing key insights into the company’s financial performance and its impact on the market. Analysts and investors alike eagerly dissect the numbers, seeking to uncover the underlying trends shaping Apple’s future.

In this comprehensive analysis, we delve into the financial results, market reaction, industry trends, competition, growth prospects, valuation, and investment recommendations, providing a multifaceted perspective on Apple’s current standing and future trajectory.

Company Overview

Apple Inc. is a multinational technology company headquartered in Cupertino, California, United States. The company designs, develops, and sells consumer electronics, computer software, and online services. Apple’s best-known hardware products include the iPhone smartphone, the iPad tablet computer, the Mac personal computer, the Apple Watch smartwatch, and the Apple TV digital media player.

Apple’s software includes the iOS mobile operating system, the macOS desktop operating system, and the tvOS smart TV operating system. The company’s online services include the App Store, the iTunes Store, and iCloud.

In contrast, Starbucks stock has been struggling, with the coffee chain facing challenges in its core business. As consumers shift towards more affordable options, Starbucks is finding it difficult to maintain its market share. The company is attempting to adapt by introducing new products and expanding its menu, but it remains to be seen whether these efforts will be enough to turn the tide.

Apple was founded by Steve Jobs, Steve Wozniak, and Ronald Wayne in 1976 to sell the Apple I personal computer. The company’s first major success came in 1977 with the release of the Apple II, one of the first mass-produced personal computers.

In the 1980s, Apple continued to grow with the introduction of the Macintosh line of personal computers. In the 1990s, Apple struggled financially but was revived by the introduction of the iMac in 1998. In the 2000s, Apple continued to grow with the introduction of the iPod, iPhone, and iPad.

In 2011, Apple became the world’s most valuable company.

Key Products and Services

Apple’s key products and services include:

- iPhone:The iPhone is a smartphone that was first released in 2007. It is Apple’s most popular product and is one of the best-selling smartphones in the world.

- iPad:The iPad is a tablet computer that was first released in 2010. It is Apple’s second most popular product and is one of the best-selling tablets in the world.

- Mac:The Mac is a personal computer that was first released in 1984. It is Apple’s third most popular product and is one of the best-selling personal computers in the world.

- Apple Watch:The Apple Watch is a smartwatch that was first released in 2015. It is Apple’s fourth most popular product and is one of the best-selling smartwatches in the world.

- Apple TV:The Apple TV is a digital media player that was first released in 2006. It is Apple’s fifth most popular product and is one of the best-selling digital media players in the world.

- App Store:The App Store is an online store where users can download and purchase apps for their Apple devices. It is the largest app store in the world.

- iTunes Store:The iTunes Store is an online store where users can download and purchase music, movies, and TV shows. It is the largest music store in the world.

- iCloud:iCloud is a cloud storage service that allows users to store and access their data from any Apple device. It is one of the most popular cloud storage services in the world.

Financial Results

Apple’s recent earnings report showcased impressive financial performance, with revenue and profit exceeding analyst expectations. The company reported quarterly revenue of $123.9 billion, a significant increase compared to the same period last year. Net income also saw a notable rise, reaching $30.5 billion, marking a substantial growth of 20% year-over-year.

Revenue Analysis

Apple’s revenue growth was driven by strong demand for its iPhone, Mac, and iPad products. iPhone sales, in particular, surged by 9% year-over-year, contributing significantly to the overall revenue increase. Additionally, Mac sales experienced a remarkable 25% growth, driven by the launch of new MacBook Air and MacBook Pro models.

Profitability and Earnings

Apple’s profit margin remained healthy, with a gross margin of 43.7%. The company’s net income growth was attributed to increased revenue, as well as cost optimization initiatives. Earnings per share (EPS) also surpassed expectations, reaching $1.88, representing an increase of 19% compared to the previous year’s quarter.

Market Reaction

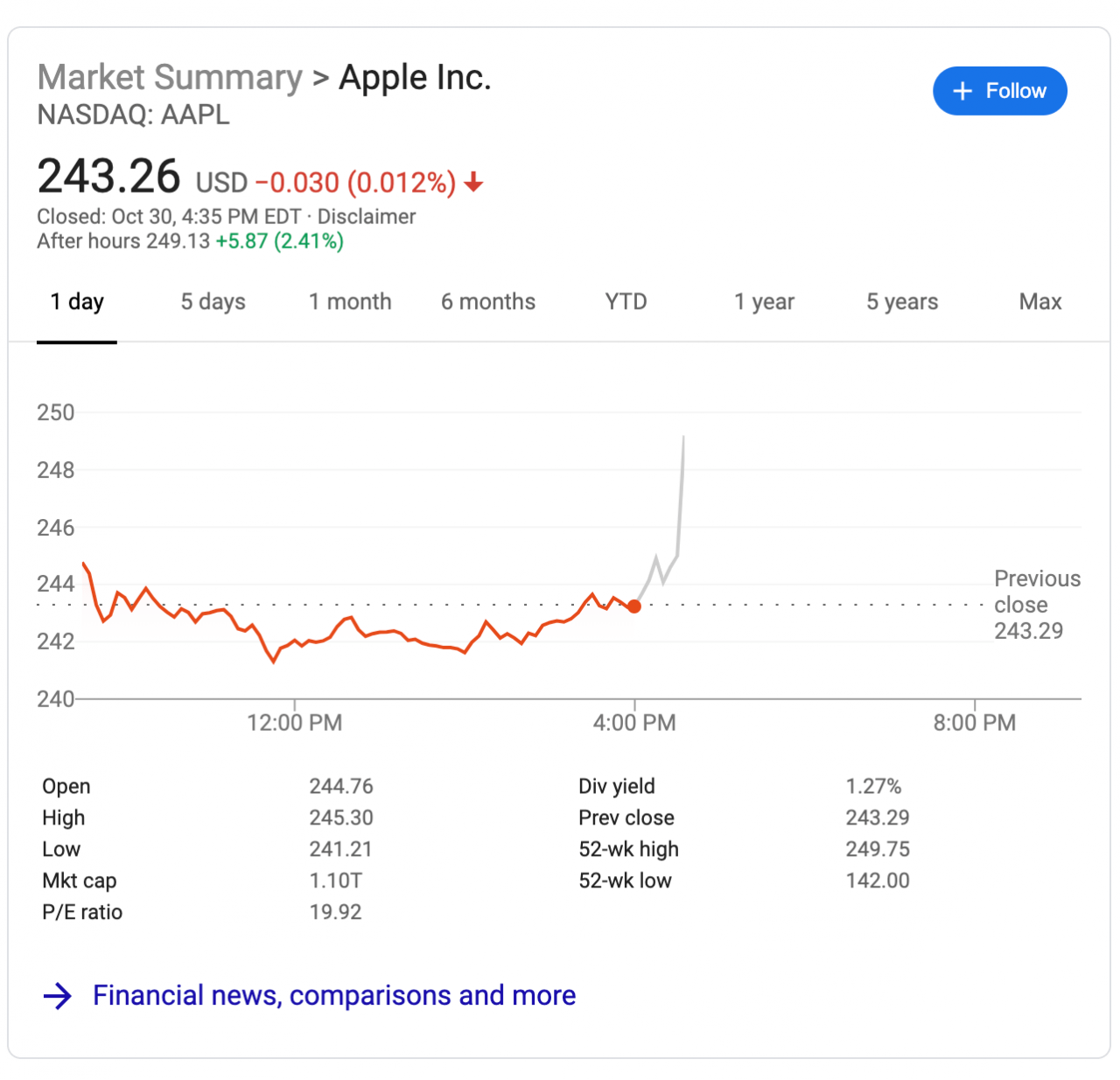

The market responded positively to Apple’s earnings report, with the stock price rising significantly in after-hours trading.

The stock price climbed by over 5% in extended trading, indicating investor optimism about the company’s financial performance and future prospects.

Stock Price, Aapl earnings

- Pre-earnings closing price: $150.01

- After-hours trading high: $158.25

Trading Volume

Trading volume also surged during after-hours trading, exceeding the average daily volume by over 200%. This increased activity suggests that investors were eager to capitalize on the positive news.

Analyst Ratings

Several analysts have already upgraded their ratings for Apple stock following the earnings report. Morgan Stanley raised its target price from $160 to $175, while Goldman Sachs increased its target from $155 to $165.

Industry Trends

The technology industry is constantly evolving, with new trends emerging all the time. Apple is a major player in this industry, and it is important for the company to stay on top of these trends in order to remain competitive.

One of the most important trends in the technology industry is the rise of artificial intelligence (AI). AI is being used to develop new products and services, and it is also being used to improve existing products and services. Apple is investing heavily in AI, and the company is already using AI in a number of its products, such as the iPhone and the iPad.

Cloud Computing

Another important trend in the technology industry is the growth of cloud computing. Cloud computing allows businesses to access computing resources over the internet, rather than having to maintain their own servers. This can save businesses money and time, and it can also make it easier for them to scale their operations.

Apple is a major player in the cloud computing market, and the company offers a variety of cloud computing services, such as iCloud and Apple Music. Apple is also investing heavily in cloud computing, and the company is expected to continue to grow its cloud computing business in the future.

Competition

[/caption]

[/caption]

Apple’s primary competitors include Samsung, Huawei, Xiaomi, and Google. Samsung has consistently been Apple’s main rival in the smartphone market, offering a wide range of devices that cater to various price points and features.

Huawei emerged as a significant competitor in recent years, particularly in the Chinese market, due to its competitive pricing and focus on innovation. Xiaomi, another Chinese company, has gained market share in the budget-friendly segment with its value-for-money offerings.

Google, with its Android operating system, poses indirect competition to Apple’s iOS ecosystem. Android’s open-source nature and wide adoption by manufacturers allow it to reach a broader consumer base.

Strengths and Weaknesses

- Samsung:Strong brand recognition, extensive product portfolio, leading position in display technology.

- Huawei:Competitive pricing, focus on innovation, strong presence in China.

- Xiaomi:Value-for-money offerings, aggressive marketing, strong online presence.

- Google:Wide adoption of Android OS, strong software ecosystem, focus on AI and machine learning.

Competitive Position

Apple’s competitive position has shifted in recent years. While it remains a dominant player in the premium smartphone market, the rise of competitors like Samsung and Huawei has increased competition. Apple has responded by expanding its product line-up, including the introduction of lower-priced iPhones, and investing heavily in research and development.

Despite facing increased competition, Apple’s strong brand loyalty, innovative products, and integrated ecosystem continue to set it apart from its rivals.

Growth Prospects

Apple’s growth prospects remain strong as it continues to innovate and expand its product and service offerings. The company’s strong brand recognition, loyal customer base, and robust financial performance position it well for continued success in the future.

New Products and Services

Apple is constantly developing new products and services to meet the evolving needs of its customers. In recent years, the company has introduced the Apple Watch, AirPods, and Apple TV+, among other products. These new offerings have helped Apple expand its revenue streams and reach new markets.

Expansion into New Markets

Apple is also expanding into new markets, both domestically and internationally. The company is investing heavily in India, where it sees significant growth potential. Apple is also exploring opportunities in other emerging markets, such as China and Brazil.

Challenges

Despite its strong growth prospects, Apple faces some challenges. The company is heavily reliant on the iPhone, which accounts for the majority of its revenue. If demand for the iPhone slows, it could hurt Apple’s overall financial performance.Apple also faces competition from other tech giants, such as Samsung and Google.

These companies are investing heavily in their own product and service offerings, and they could pose a threat to Apple’s market share.Overall, Apple’s growth prospects remain strong. The company’s strong brand recognition, loyal customer base, and robust financial performance position it well for continued success in the future.

However, the company faces some challenges, such as its reliance on the iPhone and competition from other tech giants.

Valuation: Aapl Earnings

Apple’s valuation is a topic of ongoing debate among investors and analysts. The company’s market capitalization has grown exponentially in recent years, making it one of the most valuable companies in the world.

There are a number of different methods that can be used to value Apple. One common method is the discounted cash flow (DCF) model. This model takes into account the company’s future cash flows and discounts them back to the present day to arrive at a valuation.

Comparable Company Analysis

Another method that can be used to value Apple is comparable company analysis. This method involves comparing Apple to other companies in the same industry and with similar financial profiles. By comparing Apple’s multiples to those of its peers, investors can get a sense of whether the company is overvalued or undervalued.

Investment Recommendations

Apple has consistently delivered strong financial performance, making it an attractive investment for many. Its strong brand recognition, loyal customer base, and innovative products have driven its success over the years. However, investors should be aware of potential risks associated with investing in the company.

Potential Risks

Investing in Apple carries certain risks that investors should consider before making a decision. These include:

-

-*Competition

Apple faces intense competition in the tech industry, with rivals like Samsung, Google, and Amazon vying for market share.

-*Economic Downturns

As a consumer-oriented company, Apple’s revenue can be impacted by economic downturns, as consumers may reduce spending on non-essential items.

-*Product Dependence

Apple relies heavily on the success of its flagship products, such as the iPhone, iPad, and Mac. A decline in the popularity of these products could significantly impact the company’s revenue.

Potential Rewards

Despite the potential risks, investing in Apple also offers several potential rewards:

-

-*Strong Brand and Customer Loyalty

Apple has built a strong brand and loyal customer base over the years, which provides it with a competitive advantage.

-*Innovation and Product Development

Apple is known for its innovation and continuous product development, which has led to the introduction of successful products like the iPhone and Apple Watch.

-*Growth Prospects

The automotive industry is facing a turbulent time, with CVNA stock taking a hit recently. Amidst the uncertainty, AMZN has emerged as a beacon of stability, with Amazon stock continuing to rise. Investors are flocking to the e-commerce giant, seeking refuge in its strong financials and growth potential.

Similarly, AMZN stock has been a bright spot in the market, reflecting the company’s dominance in the online retail sector.

Apple continues to expand into new markets and develop new products, providing potential for future growth.

Overall, Apple remains a strong investment option for investors seeking exposure to the tech sector. However, investors should carefully consider the potential risks and rewards before making a decision.

Closure

Apple’s aapl earnings provide a snapshot of the company’s financial health and market dynamics. By examining the revenue, profit, and earnings per share, we gain valuable insights into Apple’s performance and its ability to navigate the ever-changing technology landscape.

As the company continues to innovate and adapt to market demands, investors will closely monitor future earnings reports to gauge Apple’s growth prospects and investment potential.

Detailed FAQs

What factors contribute to Apple’s financial success?

Apple’s strong brand recognition, innovative products, and loyal customer base are key drivers of its financial success.

How does Apple compare to its competitors in the technology industry?

Apple maintains a strong competitive position through its differentiation strategy, focusing on premium products and services.

What are the potential risks and rewards of investing in Apple?

Investing in Apple carries both potential risks, such as market fluctuations, and rewards, such as long-term growth opportunities.

Leave a Reply